Commerce Questions and Answers

Test and improve your knowledge of the fundamentals of buying and selling with these Commerce past questions and answers.

Test and improve your knowledge of the fundamentals of buying and selling with these Commerce past questions and answers.

N24.65 million

N17.00million

N9.35 million

N7.65million

Correct answer is C

No explanation has been provided for this answer.

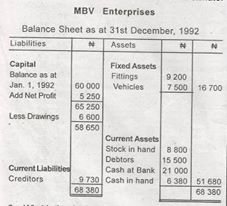

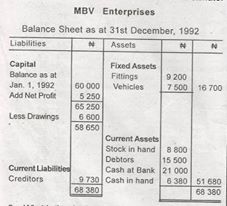

What is the working capital as at December 31,1992?

N65 250

N60 000

N48 650

N41 950

Correct answer is D

No explanation has been provided for this answer.

N15,000

N20,000

N12,000

N25,000

Correct answer is C

Since the policy is with average clause the formula used in calculating his compensation is

\(\frac{\text{Amount insured x total actual loss}} {\text{Total actual value of property}}\)

By this formula the compensation will be

Amount insured = N30,000

Amount loss = N40,000

Actual Value = N100,000

=\(\frac{30,000 \times 40, 000}{100,000}\)

= \(\frac{1200000000}{100,000}\) = 12,000

1 : 4

5 : 1

3 : 1

2 : 1

Correct answer is A

Using the Balance Sheet, the current ratio is calculated by dividing current assets by current liabilities:

Current assets = stock + debtors + banks + cash

current liabilities = drawings + creditors + accruals

current assets = 2000 + 1000 + 100 + 600 =3700

current liabilities = 2000 + 200 + 300 = 2500

3700 ÷ 2500 = 1.4

N200,000

N190,000

N170,000

N175,000

Correct answer is C

The cost of goods sold is calculated through the formula below

opening stock + purchases – closing stock.

If we go by the formula above it is

N50,000 + N 200,000 - N80,000 = N170,000.