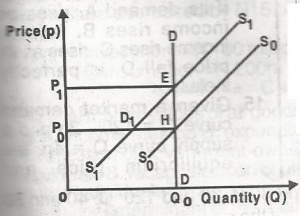

The diagram above explains the effect of government's...

The diagram above explains the effect of government's imposition of an indirect tax on a good characterized by zero price elasticity of demand. The tax imposed is borne

A.

Totally by the consumer

B.

Totally by the producer

C.

Equally by both the consumer and the producer

D.

By the the government

Correct answer is A

No explanation has been provided for this answer.

Similar Questions

A shift in the production possibility frontier could result from ...

A typical feature of a market economy is that ...

Deficit budget means that government’s ...

Economic problem arises as a result of ...

In order to increase revenue, government should tax commodities for which demand is ...