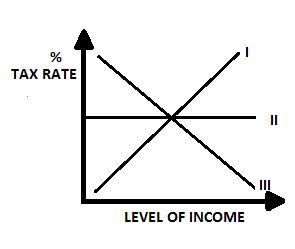

The curve labeled III illustrate a system of taxation

...

The curve labeled III illustrate a system of taxation

Regressive tax

Progressive tax

Value added tax

Proportional tax

Correct answer is A

A regressive tax falls as incomes increases while progressive tax rises as income increases. Proportional tax is a flat rate while value added tax is the tax imposed on goods and services at each stage of production.

Similar Questions

Given that Y = C + 1, where C = 50 + 0.75 and 1 = N45m, what is the equilibrium level of income? ...

If the demand elasticity coefficient of cars is 0.5, it implies that the demand for petrol is ...

Consumers have access to a variety of goods through the activities of the ...

Public expenditure can be financed from all the following sources except the ...

A company's expenditure on raw materials is regarded as ...

The law of demand states that ...

Which of the following is NOT a type of business ownership? ...

The reduction in the value of a country’s currency in relation to the value of the currencies ...

The meaning of 'Dumping' is selling goods in a foreign market ...

Which of the following strategies will provide more employment opportunities for Nigerians ...