To account for expenses paid by head office on behalf of the branch, the branch should___________

Debit profit and loss account and credit head office account

Debit head office account and credit cash

Credit cash and debit profit and loss account

Credit profit and loss account and debit head office account

Correct answer is A

The head office maintains a book, (branch account) more or less like other personal accounts, so that any expenses incurred on behalf of the branch will also be debited to the branch account. Similarly, in the branch books, there will be head office accounts

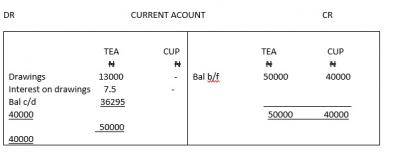

36,925Cr

40,000Cr

50,000Dr

36,295Dr

Correct answer is A

Drawings: 3000 + 2000 + 4000 + 1500 + 2500 = 13000

Which of the following is a conversion cost?

Factory overhead

Purchases

Material cost

Wages

Correct answer is A

Conversion costs are costs required to convert raw materials into finished goods

Formula for conversion cost= direct labor+ factory overheads

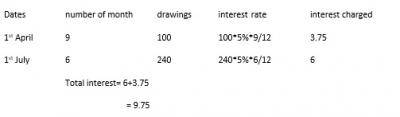

#511.25 debit

#500.00 credit

#349.75 debit

#340.00 credit

Correct answer is C

The amount withdrawn by the partners for their personal use out of the firm is known as drawings. Interest are charged on this drawings

Cost of rent as an expense can be apportioned to all department on the basis of:

No of employees

Stock value

Space occupied

Wages

Correct answer is C

Indirect expenses are allocated among departments in order to ascertain the profits or loss made by each department.

JAMB Subjects

Aptitude Tests