What would be likely to increase inflation in any economy?

Increase in demand

Reduce public spending

Control excessive import

Increase in direct tax

Correct answer is A

Excess demand without a corresponding increase in supply causes inflation.

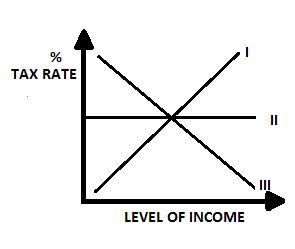

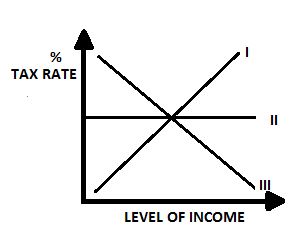

The curve labeled III illustrate a system of taxation

Regressive tax

Progressive tax

Value added tax

Proportional tax

Correct answer is A

A regressive tax falls as incomes increases while progressive tax rises as income increases. Proportional tax is a flat rate while value added tax is the tax imposed on goods and services at each stage of production.

The curve labeled II illustrates a system of taxation

Proportional tax

Regressive tax

Value added

Progressive tax

Correct answer is A

A proportional tax is a flat rate payment of tax. The same level of tax is paid irrespective of the level of income or wealth.

Isocost and isoquant can be attributed to

Theory of consumer behaviour

Theory of cost

Theory of production

Theory of value

Correct answer is C

No explanation has been provided for this answer.

All the following are properties of an indifference curves except

It can intersect

It slopes downward from left to right like that of a normal demand curve

As it shift rightward it indicate higher and higher level of satisfaction

It does not intersect

Correct answer is A

No explanation has been provided for this answer.

JAMB Subjects

Aptitude Tests