A clause that prevents the insurer from paying under a policy if the insured killed himself is?

exceptional clause

revival clause

accidental clause

suicide clause

Correct answer is D

The “suicide clause.” Usually, this clause states that no death benefit will be paid if the insured commits suicide within two years of taking out a policy. Whenever an insured person replaces an existing life insurance policy with a new one, the time clock for the suicide clause is set back to zero and starts over again.

A professional charged with the responsibility of assessing loss in insurance

underwriter

adjuster

actuary

broker

Correct answer is B

A loss adjuster is an insurance agent who assesses the amount of compensation that should be paid after a person has claimed on their insurance policy.

Which of the following operations will not run a slide show in MS PowerPoint?

pressing F5

pressing shift +f5

choosing the slide show tab

clicking on the slide show icon bar

Correct answer is A

No explanation has been provided for this answer.

A risk is classified uninsurable when the

extent of the loss can be calculated

risk will occur no matter the precaution taken

risk may not happen

insurance company cannot pay

Correct answer is B

Uninsurable risk is a condition that poses unknowable or unacceptable risk of loss or a situation in which the insurance would be against the law. Insurance companies limit their losses by not taking on certain risks that are very likely to result in a loss.

In many cases catastrophes, such as earthquakes, have become uninsurable risks. a situation for which an insurance company will not provide insurance, because, for example, it is certain to happen: A person suffering from a terminal illness is considered to be an uninsurable risk.

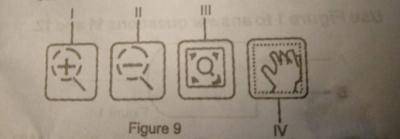

The part of the Corel Draw window labelled II in the diagram above is called?

zoom in

pan

zoom out

zoom to fit

Correct answer is A

No explanation has been provided for this answer.

WAEC Subjects

Aptitude Tests