Which of the following conditions must be met before an insurer is under obligation to pay claim

loss notification

premium payment

completion of proposal form

submission of policy paper to the insurer

Correct answer is B

In insurance, the insurance policy is a contract between the insurer and the insured, known as the policyholder, which determines the claims which the insurer is legally required to pay. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. The insurer is only obligated to pay for claims if the insured keeps their own part of the bargain by paying the premium.

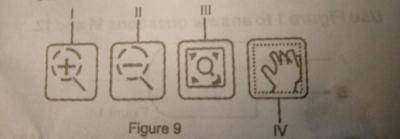

The shortcut key for the open dialog box in MS Word is ?

Alt + F12

Ctrl + F12

F12

shift + f12

Correct answer is B

No explanation has been provided for this answer.

burglary policy

public liability policy

goods-in-transit policy

money policy

Correct answer is D

Money insurance policy provides cover for loss of money in transit between the insured’s premises, bank and other specified places occasioned by robbery, theft or any other fortuitous cause. It also provides cover for loss of money in the business premises, safe or vault, etc.

One function of operating system is ?

power supply allocation

file corruption and deletion

flowcharting

resource allocation

Correct answer is D

No explanation has been provided for this answer.

The duty of a loss assessor is to ensure

adequate compensation to the insured

payment of premium to the insurer

that risk manager identifies the risk properly

that insurance broker collects commission

Correct answer is A

A Loss Assessor is appointed by the policyholder when they need to submit a substantial or complex claim.

Independent entity hired and paid by the insured (policy holder) to negotiate an insurance claim with the insurer (insurance company). The loss assessor receives a fee that is usually a percentage of the claim amount received by the insured.

WAEC Subjects

Aptitude Tests